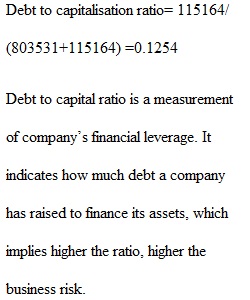

Q How would you assess the overall risk structure of the Apple Inc in terms of its operating risks and financial risk (debt-to-capitalization ratio)? Responses only need to be a couple of paragraphs. Would you invest in Apple Inc? Why or why not?

View Related Questions